Estate and Succession Planning

Dean Mead’s Estate and Succession Planning Department is one of the largest and most respected groups of estate planning attorneys in Florida. We are frequently…

Dean Mead’s Estate and Succession Planning Department is one of the largest and most respected groups of estate planning attorneys in Florida. We are frequently…

Dean Mead’s Tax Department handles tax planning issues for businesses and individuals. The attorneys in our department have extensive experience in a full range of…

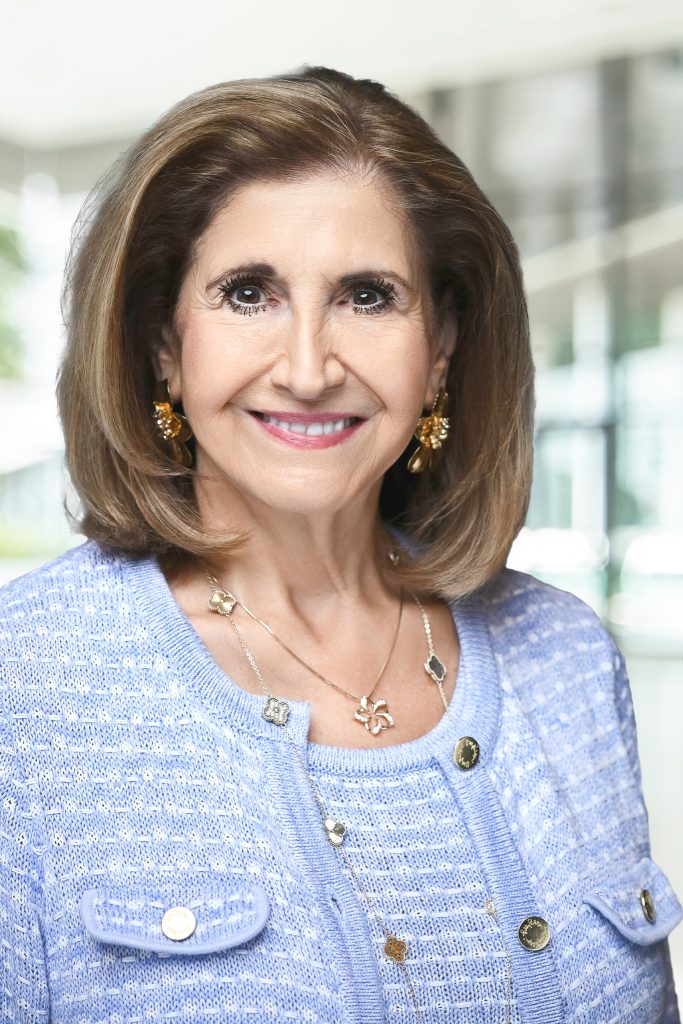

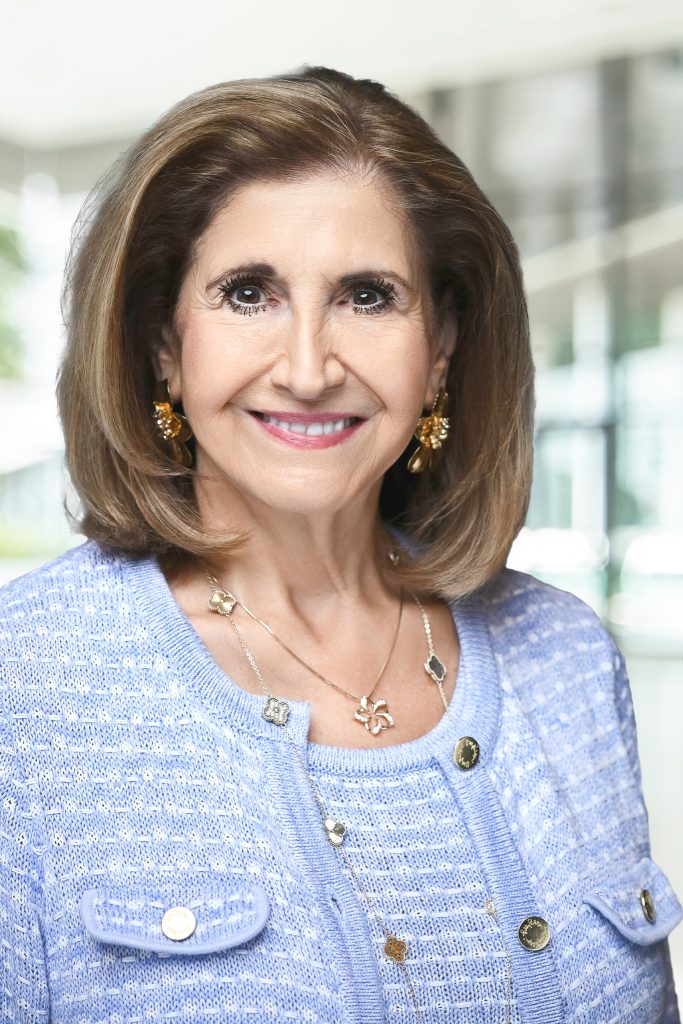

Lauren is Chair of the firm’s Estate and Succession Planning Team and specializes in techniques to reduce or avoid paying estate tax such as family limited partnerships, grantor retained annuity trusts (GRATs), sales to intentionally defective trusts, charitable trusts, lifetime gifts and generation skipping trusts. Particular emphasis includes planning for the succession of closely held or family business. She also handles many contested tax matters in the transfer tax area, ranging from audits of returns and administrative appeals within the IRS to Tax Court and Federal District Court litigation. Lauren handles the entire gamut of administration of estates and trusts, including contested matters of will and trust interpretation and reformation.

We would love to talk with you about how we may assist you. However, please know that contacting us through this page does not establish an attorney-client relationship; no attorney-client relationship will be established until you and we agree to representation. You should not send us any confidential information through contact from this page or until requested by the attorney, and we will not treat any information you choose to provide as confidential.